Empirical Finance: Identification Strategies in Corporate Finance - 2.5 ECTS

The course is designed as a first-year Ph.D. course. The prerequisites are knowledge of corporate finance theory and econometrics at a M.Sc. level and an ability to work independently with data using a statistical program such as Stata.

Students must participate in the whole course and do all problem sets.

The aim of the class is to introduce PhD students in finance and related fields to identification strategies in corporate finance.

methods used to identify causal effects in corporate finance.

We will examine how to estimate causal effects in the presence of

potentially unobserved confounding factors and how to make proper

statistical inference about empirical estimates.

The goal of the course is to provide PhD students with a methodological

framework that will enhance their ability to design sound identification

strategies in the area of corporate finance.

The course is designed to provide an introduction to some of the empirical methods used to identify causal effects in corporate finance. We will examine how to estimate causal effects in the presence of potentially unobserved confounding factors and how to make proper statistical inference about empirical estimates.

1. The students will be introduced to the main empirical methods used to identify causal effects in corporate finance. The lectures covers the main econometric challenges as well as guidance on how to estimate causal effects.

2. The course combines lectures on microeconometrics with lectures on seminal papers that apply the empirical methods to research questions in the area of corporate finance.

3. The course has a two problem sets that students must complete.

Teaching style

Lectures

Lecture Plan

Lecture 1: Correlation is not causality: Linear regression models, basic assumptions and causal inference (3 hours)

Lecture 2: Instrumental variables and natural experiments (3 hours)

Lecture 3: Difference-in-differences and panel data (3 hours)

Lecture 4: Regression discontinuity design (2 hours)

Lecture 5: Research design and identification strategies (1 hour)

| Date and time | Topic | Readings: |

|

26/3 9-12 am

D4.20

|

Correlation is not causality: Linear regression models, basic assumptions and causal inference |

Angrist and Pischke, Ch. 1-3. Fazzari, Hubbard, and Petersen (1988) Rajan and Zingales (1998) |

|

26/3 1-4 pm

D4.20

|

Instrumental variables and natural experiments | Angrist and Pischke, Ch. 4. Angrist and Kruger (2001) Bennedsen, Nielsen, Perez-Gonzalez, and Wolfenzon (2007) Nguyen and Nielsen (2010) |

|

27/3 9-12 am

Augustinusfonden

|

Difference-in-differences and panel data | Angrist and Pischke, Ch. 5. Yagan (2015) Bertrand and Mullainathan (2003) Bertrand, Duflo, and Mullainathan (2004) |

|

27/3 1-4 pm

Augustinusfonden

|

Regression discontinuity design | Angrist and Pischke, Ch. 6. Iliev (2010) Cunat, Gine, and Guadalupe (2012) |

The course objectives are to:

• Apply microeconometric methods in the area of corporate finance

• Identify econometric challenges in research designs in corporate finance

• Evaluate identification strategies and empirical methods used in corporate finance

• Formulate identification strategies to address econometric challenges in corporate finance

Please see 'Course content - element 3'

The course is offered through The Nordic Finance Network, and the Department of Finance at CBS will cover the course fee for PhD students from other NFN associated universities.

Course participants are expected to have read this literature before the course

Angrist and Pischke, 2008. Mostly Harmless Econometrics. Princeton University Press.

Angrist and Kruger, 2001. Instrumental variables and the search for identification: From supply and demand to natural experiments. Journal of Economic Perspectives.

Surveys of empirical methods in corporate finance: Roberts and Whited. 2013.

Registration deadline and conditions

The registration deadline is 12 February 2025. If you want to cancel your registration on the course it should be done prior to this mentioned date. By this date we determine whether we have enough registrations to run the course, or who should be offered a seat if we have received too many registrations.

If there are more seats available on the course we leave the registration open by setting a new regsitration deadline in order to fill remaining seats. Once you have received our acceptance/welcome letter to join the course, your registration is binding and we do not refund your course fee. The binding registration date will be the registration deadline mentioned above.

Payment methods

Make sure you choose the correct method of payment upon finalizing your registration:

Please note that your registration is binding after the registration deadline.

Information about the Event

Date and time Wednesday 26 March 2025 at 09:00 to Thursday 27 March 2025 at 16:00

Registration Deadline Monday 10 February 2025 at 23:55

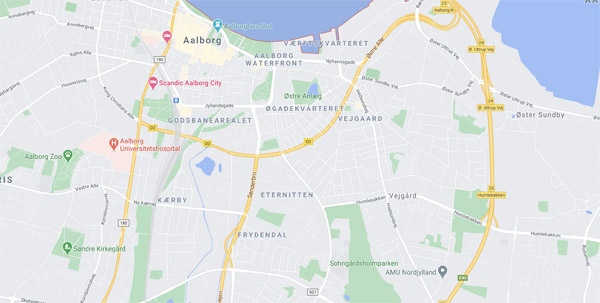

Location

Solbjerg Plads - room SP D4.20 (fourth floor)

Solbjerg Plads 3

Frederiksberg

DK-2000

Organizer

Bente Ramovic, CBS PhD School

Phone +45 3815 3138

bsr.research@cbs.dk

Loading

Loading