Advanced Asset Pricing – Fall 2022 - 7.5 ECTS

| Faculty | ||

| Assistant Professor Paul Whelan | ||

Course Coordinator |

||

| Assistant Professor Paul Whelan | ||

Prerequisites |

||

| The course begins in September and runs on consecutive days, except for Fridays’ which are seminar days. In preparation for the class students should have completed the free online course of John Cochrane including the quizzes. The course will be made available on canvas.

See www.johnhcochrane.com/asset-pricing for additional details.

In addition, the course assumes mathematical knowledge up to advanced college level or 1st year undergraduate level. This means basic analysis, univariate calculus, linear algebra, and probability. Students should be comfortable with chapters 1-10 of `Mathematics for Economics', by Michael Hoy, John Livernois, Chris McKenna, Ray Rees and Thanasis Stengos. |

||

Aim |

||

| To provide participants with a firm and rigorous knowledge and understanding of asset pricing models of finance. The course covers fundamental concepts, relations, and models but it also outlines some recent trends in the development of asset pricing models. Both discrete-time and continuous-time models are discussed. The course has a theoretical focus, but empirical studies and results are used for the evaluation of the theoretical models. | ||

Course content |

||

| To provide participants with a firm and rigorous knowledge and understanding of asset pricing models of finance. The course covers fundamental concepts, relations, and models but it also outlines some recent trends in the development of asset pricing models. Both discrete-time and continuous-time models are discussed. The course has a theoretical focus, but empirical studies and results are used for the evaluation of the theoretical models. | ||

Teaching style |

||

| 44 lectures including discussion of exercises and student presentations. Students have to pass a written mid-term assignment before being allowed to take the final exam. | ||

Lecture plan |

||

|

Each lecture takes place from 9-13

• Lecture 1: Choice Under Uncertainty

• Lecture 1: Static Portfolio Choice • Lecture 3: Static Equilibrium • Lecture 4: Present Value Relations • Lecture 5: The SDF • Lecture 6: LooP Completeness No Arbitrage • Lecture 7: Dynamics_Models_Bellman_Equation • Lecture 8: To the Data (Mehra Prescott & Hansen Singleton) • Lecture 9: Production Based Economies • Lecture 10: Habit Preferences • Lecture 11: Recursive Preferences |

||

Learning objectives |

||

| The students should obtain a solid knowledge of the key concepts, methods, theories, and models in classical and contemporary asset pricing research. They should be able to understand new asset pricing research papers and position such papers in the general asset pricing literature; to evaluate the empirical validity of mainstream asset pricing models; and to develop and analyze well-motivated minor extensions of mainstream asset pricing models. | ||

Exam |

||

|

Exam date 8 November.

The course ends with a final oral exam. The student draws a topic from a list of topics published at least two weeks before the exam. The student then has 20 minutes to prepare an oral presentation of the topic supported by calculations, illustrations, etc. on the white/black-board. The examination lasts 20 minutes including the time the examiner needs to determine the grade and communicate it to the student. The examination begins with the student giving the prepared presentation in front of the examiner for 10-15 minutes, possibly interrupted by clarifying questions by the examiner. Towards the end of the exam, the examiner might have supplementary questions related or unrelated to the topic of the presentation. |

||

Other |

||

Start date |

||

| 06/09/2022 | ||

End date |

||

| 11/10/2022 | ||

Level |

||

| PhD | ||

ECTS |

||

| 7.5 | ||

Language |

||

| English | ||

Course Literature |

||

| The course notes are a self-contained collection of notes from the leading first year PhD asset pricing books: • `Asset Pricing', John Cochrane • `Finance Decisions and Markets: A Course in Asset Pricing', John Campbell • `Theory of Asset Pricing', George Pennacchi • Selected Papers |

Information about the Event

Date and time Tuesday 6 September 2022 at 09:00 to Tuesday 11 October 2022 at 16:00

Registration Deadline Tuesday 6 September 2022 at 09:00

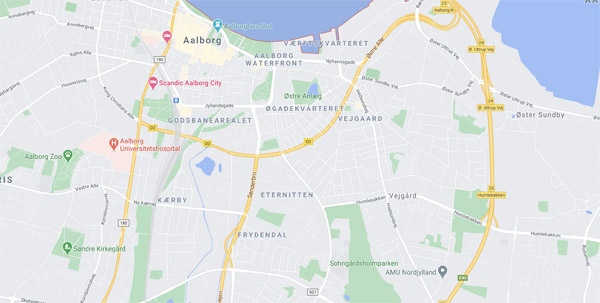

Location

Dalgas Have - Room: DH.V.0.20

Dalgas Have 15

Frederiksberg

DK-2000

Loading

Loading