Foundations of Strategy - 5 ECTS - HYBRID

Course Coordinator: Francesco Di Lorenzo

Faculty

Associate Professor Francesco Di Lorenzo

Department of Strategy and Innovation (SI), CBS

Professor Hans Christian Kongsted

Department of Strategy and Innovation (SI), CBS

Professor Johannes Luger

Universität Zürich

Professor Keld Laursen

Department of Strategy and Innovation (SI), CBS

Professor Michael Mol

Department of Strategy and Innovation (SI), CBS

Assistant Professor Julia Bodner

Department of Strategy and Innovation (SI), CBS

Assistant Professor Thomaz Teodorovicz

Department of Strategy and Innovation SI), CBS

No prerequisite

Format

Hybrid (yet, it is strongly recommended to be at CBS in person for at least 50% of the seminar)

Aim

The aim of this course is to offer an introduction to the theoretical foundation in the field of Strategy, as well as an overview of the primary topics in Strategy-related research. In addition, quantitative methods typical in Strategy research will be discussed.

Course content and structureThe course provides an overview on the most relevant theoretical traditions and topics and as well as more recent empirical developments used in the research field of Strategic Management. The aim is to offer students: i) comprehensive understanding about the foundations, assumptions and implications of economic and organizational theoretical perspectives, ii) overview of the areas of research iii) introduction about empirical methodologies. Ideally, at the end of the course students are able to engage in theory-building activities, selecting and employing theoretical approaches more appropriately linked to the economic and organizational foundations of the field of Strategy. In addition, students are able to identify suitable empirical methods and approaches in line with those more familiarly used in Strategy, and specific to the primary topic of interest. The course aims to be a balanced combination of Organizational Theory and Topics in Strategy.

More specifically, these are 3 main areas developed during the course:

1. Economic and Organizational Theories in Strategic Management2. Topics in Strategy Research

3. Methodologies

The structure of the course is based on 2 main activities and related objectives:

- Lecture. In session, papers-based discussion supported/guided by lecturing.

- Reading. Preparation of the mandatory readings for each session to come.

The course includes 9 lecture-based sessions of 3 hours each. The sessions will be highly interactive, involving students in leading discussions on the assigned readings.

The course is based on a high level of student involvement. Students are expected to be thoroughly prepared and actively participate in the material's presentation and discussion. Given the high content-to-time ratio, teaching is based on lectures, illustrations, and discussions, and its success is also based on interactive student involvement.

Assessment

To obtain the course certificates the participants are expected to show a high level of preparation and class participation.

The delivery can be either of these options:

1. A research proposal on a specific topic in Strategy covered during the course, highlighting the research gap/opportunity, arguing what would be an ideal theoretical foundation for such study and why, and describing the possible methodology and explaining the reasons of the choice.

2. A reflection on current ongoing research (chapter of the thesis, working paper, thesis proposal section, etc…) revisited from either a theoretical perspective or from a methodological perspective. It is not relevant, in this case, that the topic of discussion falls into the primary topics discussed during the course.

Format: max 5 pages (all included), 1-inch margin all around, Times New Roman, 12 pt, 1.5 interline space.

Schedule

This course is offered in a hybrid format. Students can participate in all sessions either in person on campus or online. Please indicate in your registration whether you attend on campus, online or a mix of both.

|

Session |

Area |

Topics |

Faculty |

Date |

Time |

|

1 |

Theories in Strategy |

Economic and Organizational Theories I |

Johannes Luger |

28th Jan |

13-17 |

|

2 |

Theories in Strategy |

Economic and Organizational Theories II |

Johannes Luger |

29th Jan |

9-12 |

|

3 |

Theories in Strategy |

Economic and Organizational Theories III |

Johannes Luger |

30th Jan |

9-12 |

|

4 |

Topics in Strategy |

Innovation Strategy |

Keld Laursen |

2nd Feb |

9-12 |

|

5 |

Topics in Strategy |

Strategic Human Capital |

Thomaz Teodorovicz |

3rd Feb |

9-12 |

|

6 |

Topics in Strategy |

International Business Strategy |

Michael Mol |

4th Feb |

9-12 |

|

7 |

Methods in Strategy |

Corporate Strategy |

Julia Bodner |

5th Feb |

9-12 |

|

8 & 9 |

Methods in Strategy |

Quantitative Methods I & II |

HC Kongsted |

6th Feb |

9-17 |

Lunches and coffee breaks will be included during the duration of the seminar, as well as welcome dinner.

Sessions Description and Literature

(papers will be confirmed 1 week before the start)

Session 1-3 Economic and Organizational Theories

In the three introductory sessions, each containing two modules, we will learn about important theories frequently applied in the Strategic Management domain, namely agency theory, transaction cost economics, resource based view, behavioral theory of the firm, knowledge based view, and resource dependency theory. The sessions will be highly interactive, discussion-oriented. For example, we will discuss the foundational readings of each theory (marked with a * in the reading list) and students will be assigned to act as “experts” for certain theories. Specifically, for each session there will be one or more students who will assume the role of “expert(s).” Experts are supposed to read everything for the relevant session, i.e., also the “optional readings” and the “applications.” We will also debate important phenomena in strategy by taking alternative theoretical perspectives on them. Eventually, all this should help and familiarize students when working with alternative theories on their Ph.D. topic.

Legend to read the papers below:

* Mandatory readings

+ Optional readings (for all except the session expert(s)).

^ Applications

Session 1: Foundations of the Theory of the Firm

Readings:

· * Coase, R.H. 1937. The nature of the firm, Economica 4: 386–405.

· * Penrose, E.T. 1955. Limits to the growth and size of firms. American Economic Review, 45: 531-543.

· * March, J.G. 1962. The business firm as a political coalition. Journal of Politics, 24: 663-678

· + Foss, N.J. and P. G. Klein. 2008. “Organizational Governance.” In Raphael Wittek, Tom Snijders, and Victor Nee, eds., The Handbook of Rational Choice Social Research. New York: Russell Sage Foundation. Downloadable in working paper format from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1026897

Session 1: Agency Theory

Readings:

· *Alchian, A., and Demsetz, H. 1972. Production, Information Costs, and Economic Organization. American Economic Review, 62: 777–95.

- * Jensen, M. C., and Meckling, W. H. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- + Gibbons, R. & John Roberts. 2013. Economic Theories of Incentives in Organizations. . In Robert Gibbons and John Roberts, eds. 2013. The Handbook of Organizational Economics. Princeton: Princeton University Press.

- ^ Foss, N.J. and K. Laursen. 2005. “Performance pay, delegation and multitasking under uncertainty and innovativeness: An empirical investigation,” Journal of Economic Behavior and Organization 58: 246-276.

· ^ Pepper, A. & Gore, J. 2015. Behavioral Agency Theory: New Foundations for Theorizing About Executive Compensation. Journal of Management, 41: 1045-1068.

Session 2: Transaction Cost Economics

Readings:

· * Williamson, O. E. 1991. Comparative economic organization: The analysis of discrete structural alternatives. Administrative science quarterly, 269-296.

· * Cuypers, I. R., Hennart, J. F., Silverman, B. S., & Ertug, G. 2021. Transaction cost theory: Past progress, current challenges, and suggestions for the future. Academy of Management Annals, 15(1), 111-150.

· + Macher, JT.. & Richman, B.D. 2008. Transaction cost economics: An assessment of empirical research in the social sciences. Business and Politics, 10: 1-63.

· ^ Nickerson, J. & Zenger, T. 2004. A knowledge-based theory of the firm: The problem-solving perspective. Organization Science, 15: 617-632.

Session 2: The Behavioral Theory of the Firm

● * Cyert, R. M. and March, J. G. 1992. A Summary of the Basic Concepts in the Behavioral Theory of the Firm, Chapter 7; In Cyert, R. M. & March, J. G. A Behavioral Theory of the Firm, 2nd edn, Oxford: Blackwell, 1992, 161-176.*

● * Gavetti, G., Greve, H. R., Levinthal, D. A., and Ocasio, W. (2012). The behavioral theory of the firm: Assessment and prospects. Academy of Management Annals, 6(1), 1-40.

● + Simon, H. A. 1979. Rational Decision-Making in Business Organizations, American Economic Review, 69(4): 493-513.

● + Argote, L., and Greve, H. R. 2007. A behavioral theory of the firm—40 years and counting: Introduction and impact. Organization science, 18(3), 337-349.

● ^ Greve, H. 1998. Performance, Aspirations, and Risky Organizational Change. Administrative Science Quarterly, 43: 58-86.

Session 3: Resource-based and Attention-based Theories of the Firm

● * Peteraf, M. 1993. The cornerstones of competitive advantage: A resource-based view. Strategic Management Journal, 14: 179-191.

● * Barney, J. B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17: 99-120

● Ocasio, W. 1997. Towards an Attention-based View of the Firm. Strategic Management Journal, 18: 187-206.

● + Peteraf, M. and Barney, J.B. 2003. Unraveling the resource-based tangle. Managerial and Decision Economics, 24: 309-324.

● ^ Krakowski, S., Luger, J., and Raisch, S. (2022). Artificial intelligence and the changing sources of competitive advantage. Strategic Management Journal (in-press).

Session 3: Knowledge-based and Resource-dependency Theories of the Firm

● * Grant, R.M. 1996. Toward a knowledge-based theory of the firm. Strategic Management Journal 17: 109-122.

● ^ Haas, M.R. and Hansen, M.T. 2005. When using knowledge can hurt performance: The value of organizational capabilities in a management consulting company. Strategic Management Journal, 26: 1-24.

● * Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource dependence theory: A review. Journal of management, 35(6), 1404-1427.

● ^ Casciaro, T., & Piskorski, M. J. (2005). Power imbalance, mutual dependence, and constraint absorption: A closer look at resource dependence theory. Administrative science quarterly, 50(2), 167-199

Session 4 Strategic Human Capital

In this session we will learn and discuss the study of human capital – i.e., the knowledge and skills of individuals that provide work for an organization – as a strategic resource for an organization. Specifically, we will follow the evolution of how strategy scholars conceptualize human capital as a source of competitive advantage to organizations.

Mandatory (in order of expected reading)

● Coff, R. W. 1997. Human Assets and Management Dilemmas: coping with hazards on the road to resource-based theory. Academy of Management Review, 22(2): 374–402.

● Coff, R. W., & Kryscynski, D. 2011. Drilling for Micro-Foundations of Human Capital-Based Competitive Advantages. Journal of Management, 37(5): 1429–1443.

● Campbell, B. A., Coff, R. W., & Kryscynski, D. 2012. Rethinking Sustained Competitive Advantage from Human Capital. Academy of Management Review, 37(3): 376–395.

● Starr, E., Ganco, M., & Campbell, B. A. (2018). Strategic human capital management in the context of cross‐industry and within‐industry mobility frictions. Strategic Management Journal, 39(8), 2226-2254.

● Kryscynski, D., Coff, R., & Campbell, B. 2021. Charting a path between firm‐specific incentives and human capital‐based competitive advantage. Strategic Management Journal, 42(2): 386–412.

Optional

● Kryscynski, D. 2020. Firm-Specific Worker Incentives, Employee Retention, and Wage–Tenure Slopes. Organization Science, (October): 1–24.

● Morris, S. S., Alvaraz, S. A., Barney, J. B., & Molloy, J. C. 2016. Firm-Specific Human Capital Investments as a Signal of General Value: revisiting assumptions about human capital and how it is managed. Strategic Management Journal. https://doi.org/10.1002/smj.

● Nyberg, A., Moliterno, T., Chadwick, C., & Coff, R. W. 2019. Commentary on “Rents from human capital complementarities: a relational view of value creation and value capture.” Handbook of Research on Strategic Human Capital Resources, 68–75.

● Ployhart, R. E., & Moliterno, T. P. 2011. Emergence of the human capital resource: A multilevel model. Academy of Management Review, 36(1): 127–150.

● Teodorovicz, T,; Lazzarini, S., Cabral,S., McGahan,A. (2022). Investing in general human capital as a relational strategy: evidence from arrangements with contract workers, working paper

● Wang, H. C., He, J., & Mahoney, J. T. 2009. Firm-Specific Knowledge Resources and Competitive Advantage: the roles of economic and relationship-based employee governance mechanisms. Strategic Management Journal, 30: 1265–1285.

Session 5 Innovation Strategy

This session will cover the readings that lay the foundations for an innovation perspective on strategy. The foundations of innovation studies are eclectic but is quite often based on economics. We will explore the theory and key concepts, along with the measures used within this perspective. Lastly, we will examine how innovation studies can be applied to the field of strategic management. The Eklund (2022) paper on the reading list will serve as the basis for group work during class, so it is particularly important that you read this paper beforehand (although you should of course read all the required readings).

Required readings:

● Pavitt, K. L. R. 1984. Sectoral patterns of technical change: towards a taxonomy and a theory. Research Policy, 13 (6): 343-373.

● Levin, R., Klevorick, A., Nelson, R. R., et al. 1987. Appropriating the Returns from Industrial Research and Development. Brookings Papers on Economic Activity (3): 783-820.

● Henderson, R., & Clark, K. B. 1990. Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Administrative Science Quarterly, 35 (1): 9-30.

● Cohen, W. M., & Levinthal, D. A. 1990. Absorptive Capacity: A New Perspective on Learning and Innovation. Administrative Science Quarterly, 35(1, Special Issue: Technology, Organizations, and Innovation): 128-152.

● Laursen, K., & Salter, A. J. 2006. Open for Innovation: The role of openness in explaining innovative performance among UK manufacturing firms. Strategic Management Journal, 27(2): 131-150

● Eklund, J. C. (2022). The knowledge‐incentive tradeoff: Understanding the relationship between research and development decentralization and innovation. Strategic Management Journal, 43(12): 2478-2509.

Optional readings:

● Teece, D. 1986. Profiting from technological innovation: implications for integration, collaboration, licensing, and public policy. Research Policy, 15 (6): 285-305.

● Anderson, P., & Tushman, M. L. 1990. Technological discontinuities and dominant designs: A cyclical model of technological change. Administrative Science Quarterly, 35 (4): 604-633.

● Mowery, D., Oxley, J., Silverman, B. 1996. Strategic Alliances and Interfirm Knowledge Transfers. Strategic Management Journal, 17 (Winter 96 special issue): 77-91.

● Cohen, W. M., R. R. Nelson, et al. (2000). "Protecting Their Intellectual Assets: Appropriability Conditions and Why U.S. Manufacturing Firms Patent (or Not)." National Bureau of Economic Research Working Paper 7552.

● Katila, R., and Ahuja, G. 2002. Something Old, Something New: A Longitudinal Study of Search Behaviour and New Product Introduction. Academy of Management Journal, 45(8): 1183-1194.

● Argyres, N. S., Silverman, B. S. 2004. R&D, organization structure, and the development of corporate technological knowledge, Strategic Management Journal, 25(8-9): 929 - 958.

● Kaiser, U., Kongsted, H. C., Laursen, K., & Ejsing, A.-K. (2018). Experience matters: The role of academic scientist mobility for industrial innovation. Strategic Management Journal, 39(7), 1935-1958.

● Moreira, S., Klueter, T. M., & Tasselli, S. 2020. Competition, technology licensing-in, and innovation. Organization Science, 31(4): 1012-1036.

Sessions 6 International Business Strategy

Sessions 7 Corporate Strategy

Sessions 8 and 9 Quantitative Methods

The session “Methods in Strategy: Quantitative” will help students to be able to identify suitable econometrics approaches and data sources in line with those commonly used in Strategy. It will also highlight some of the challenges and potential pitfalls that are commonly encountered.

Compulsory Readings:

● RA Bettis (2012). The search for asterisks: Compromised statistical tests and flawed theories, Strategic Management Journal, 33 (1), 108-113.

● R Bettis, A Gambardella, C Helfat, W Mitchell (2014). Quantitative empirical analysis in strategic management, Strategic Management Journal, 35 (7), 949-953.

● P Criscuolo, O Alexy, D Sharapov, A Salter (2019). Lifting the veil: Using a quasi‐replication approach to assess sample selection bias in patent‐based studies, Strategic Management Journal, 40 (2), 230-252.

Registration Deadline and Conditions

The registration deadline is 18 December 2025. If you wish to cancel your registration, it must be done by this date. By this deadline, we determine whether there are enough registrations to run the course or decide who should be offered a seat if we have received too many registrations.

Information about the Event

Date and time Wednesday 28 January 2026 at 13:00 to Friday 6 February 2026 at 20:00

Registration Deadline Monday 26 January 2026 at 23:55

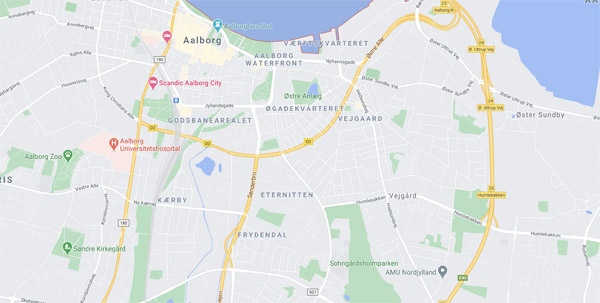

Location

Kilen - room KL 2.53 (second floor)

Kilevej 14A

Frederiksberg

DK-2000

Organizer

Nina Iversen, CBS PhD School

Phone +45 3815 2475

ni.research@cbs.dk

Loading

Loading